Understanding how to calculate debt-to-income ratio (DTI) is essential if you’re applying for a mortgage, budgeting for a big purchase, or simply want to take control of your financial health.

In this guide, we’ll break down the DTI formula, how to use it, and why lenders pay close attention to this number.

📌 What is a Debt-to-Income Ratio?

The debt-to-income ratio compares your monthly debt payments to your gross monthly income. It gives you and lenders a snapshot of how much of your income is used to repay debts.

For example, if you make $5,000 per month and spend $1,500 on loan payments, your DTI would be 30%.

A lower DTI ratio indicates that you have a manageable amount of debt relative to your income, which is attractive to lenders.

🧮 How to Calculate Debt-to-Income Ratio

Step 1: Add Up Your Monthly Debt Payments

Include:

- Mortgage or rent

- Credit card minimum payments

- Auto loans

- Student loans

- Personal loans

- Any other recurring monthly debts

📝 Avoid adding variable expenses like groceries or utilities.

Step 2: Identify Your Gross Monthly Income

This includes all income before taxes, such as:

- Salary or wages

- Freelance or business income

- Rental income

- Alimony or child support (if applicable)

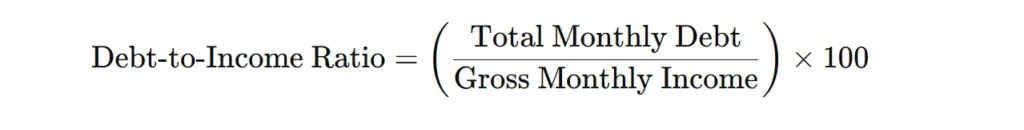

Step 3: Use the DTI Formula

💡 Example:

- Monthly Debt: $2,000

- Gross Monthly Income: $6,000

- DTI = (2000 / 6000) × 100 = 33.3%

📊 What is a Good DTI Ratio?

| DTI Range | What It Means |

|---|---|

| Under 20% | Excellent – Very Low Risk |

| 20%–35% | Generally Good |

| 36%–43% | Caution – Watch Spending |

| Over 43% | Risky – May Impact Loan Approval |

👉 According to Investopedia, most lenders prefer a DTI of 36% or lower. Read more in our detailed post on What Is a Good Debt-to-Income Ratio?

🧰 Try Our Free Online DTI Calculator

Want to skip the math? Use our Debt-to-Income Ratio Calculator to instantly see your percentage and assess your borrowing power.

It’s 100% free, easy to use, and works on all devices.

💬 Why Your DTI Ratio Really Matters

Lenders, especially mortgage providers, often consider your DTI before approving a loan. A high DTI could mean higher risk, which might lead to loan rejection or higher interest rates.

For example, the Consumer Financial Protection Bureau (CFPB) notes that under Qualified Mortgage rules, lenders usually prefer a DTI under 43%. Learn more from their official guidance.

Even if you’re not applying for a loan, understanding your DTI helps you assess your overall financial wellness.

✅ How to Lower Your DTI Ratio

If your DTI is higher than desired, consider the following tips:

- Pay off small loans or credit card balances

- Consolidate or refinance existing loans

- Increase your income via freelance or part-time work

- Avoid taking on new debt

- Make more than the minimum payments on current loans

We’ve compiled a full list of effective methods in our blog: How to Improve Your Debt-to-Income Ratio

🧭 Beyond DTI: Building Stronger Financial Habits

While DTI is important, it’s only one piece of your financial picture. You can also:

- Build an emergency fund with 3–6 months’ expenses

- Track your spending using budgeting apps like YNAB or Mint

- Maintain a healthy credit score by checking your report regularly at AnnualCreditReport.com

🔗 Related Topics You Might Like

- 🔸 What is a Good Debt-to-Income Ratio

- 🔸 DTI for Mortgage Loan Approval

- 🔸 Front-End vs Back-End DTI Explained (coming soon)

- 🔸 DTI vs Credit Score: What Lenders Really See (coming soon)

🏁 Final Thoughts

Knowing how to calculate debt-to-income ratio is a powerful way to improve your financial awareness. Whether you’re preparing for a loan, managing household expenses, or planning for the future, your DTI gives you a solid foundation for smarter financial planning.

👉 Use our DTI calculator today and take charge of your financial future.